risk man·age·ment

noun

(in business) the forecasting and evaluation of risks together with the identification of procedures to avoid or minimize their impact.

Most entrepreneurs and business owners are risk takers, willing to invest resources with an expectation and hope, but no guarantee, of reward. But, from the viewpoint of insurance, “risk” is another word for “peril” and refers to things that can go wrong. Crime, vandalism, fire, a personal injury lawsuit, a computer virus, equipment breakdown, nondelivery of raw materials, death or illness of a key employee—the list of adverse events which can cause economic harm to your business or organization goes on.

Risk management is a broad topic. It involves taking steps to minimize the likelihood of things going wrong, a concept known as loss control. It also involves the purchasing of insurance to reduce the financial impact of adverse events on a company when, despite your best efforts, bad things happen. No one likes thinking about what could go wrong. Nevertheless, as a prudent manager, you should understand the risks your business faces. Until you identify risks, you can’t make good decisions about managing them.

Products

Workers Compensation

What makes Patriot Risk & Insurance Services different? We provide individualized services and never blindly accept traditional risk control methods. The area of workers compensation cost containment is rapidly changing. New strategies utilizing pre hiring Integrity Testing and Electrodiagnostic Functional Assessment have resulted in reductions of 56% in claims and up to 88% reduction in claims costs. Our approach is to bring to the table a Turn Key strategy and team consisting of Claims Adjusters, doctors, attorneys and service providers focused on a common goal of reducing claims and costs.

Workers Comp for many businesses account for their third largest personnel costs behind payroll and group medical costs. For any business, a reduction in workers’ compensation claims means a direct benefit to the businesses bottom-line. For many American businesses, workers compensation costs become a major source of contention when claims are filed by employees on a post termination basis or the injured employee obtains legal representation even though the claim is being processed properly and the employee is receiving defined benefits.

The secret to reducing workers comp costs is to first prevent the claims before they occur, if that fails controlling costs associated with the claims is critical.

We at Patriot Risk & Insurance Services take a proactive, systematic approach to providing your organization with a quick and economically sound intervention strategy for reducing workers comp claims. Our services focus upon:

GET YOUR WORKERS COMPENSATION QUOTE WITHIN 48 HOURS

Please download our quote request form here. Provide ALL information requested and email to [email protected].

get a quote or schedule a meeting today

GAP Analysis

CONCERNED YOU’RE NOT COVERED FOR ALL YOUR RISKS?

NOW YOU CAN HAVE PIECE OF MIND WITH GAP ANALYSIS!

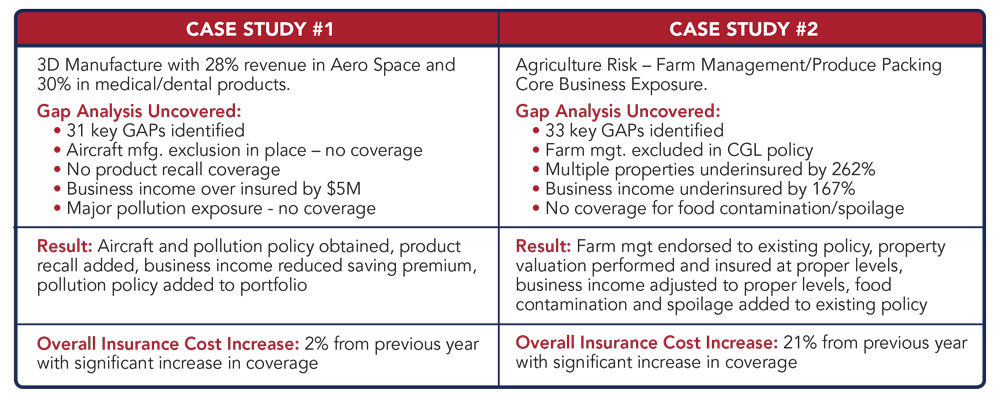

It’s a process that evaluates the operations of a business, understanding what the business does, who it does it with and what exposures are created that pose a risk to human, financial or property capital of the business if not properly managed. The Operational Review is then compared to current commercial policy provisions. The resulting review spotlights areas of over coverage, under coverage, or complete Gaps in coverage (Being Bare). The process includes a detailed, line by line dashboard inventory of all coverage limits.

100% OF OUR REVIEWS IDENTIFIED SERIOUS COVERAGE GAPS

get a quote or schedule a meeting today

Home Health

Where Others Can’t…Patriot Can!

Nurse Hotline: Immediate access to a nurse at the time of injury allowing the injured employee to receive professional medical advice prior to filing a claim.

Risk Management Information System (RMIS): Access to state of the art technology platform offering specialized loss, premium and policy summary reports.

Predictive Modeling: Assesses previous claims and delivers a rating based on expected ultimate claim severity. This allows the TPA to focus efforts on the claims that are most at-risk for adverse development.

Custom Tailored risk management programs.

Premium Financing: Low down payment option delivering better cash flow and management. 10% down and 10 installments for annual policies.

End-to-End Claim Management Advocate: Specialized claim summary reporting throughout the claim process.

Benchmarking Analysis: Comparison of results to peer members within the Healthcare Program.

get a quote or schedule a meeting today

Cyber Security

American businesses have increased their reliance on technology and the Internet to conduct their everyday activities. This has resulted in huge loss exposures that are not covered under traditional insurance programs. Cyber liability attacks on small business are on the rise in recent years, according to Symantec’s 2016 Internet Security Threat Report. Small businesses are ideal targets because they lack the resources, awareness and training to guard against such threats. If you take payments through your website, collect sensitive Personal Identifiable Information (PII) or collect sensitive employee information you have a Cyber Liability exposure.

The National Cyber Security Alliance reports that in the past two years, 40% of small business have been hacked. Of the business that were hacked, 60% were out of business within six months due to the financial costs associated with the breach. These costs include; expenses associated with the investigation and mitigation of the breach, notification, help desk and credit monitoring costs, civil and regulatory penalties costs. The FCC recently fined Cox Communications $600,000 for data security failure affecting 60 customers.

Coverage for cyber/network security breaches is new, very specialized and generally not included in most other insurance policies. If your business does not have any insurance or financial risk backup, you’re risking everything and can go out of business. Many business owners feel that they’ve implemented all the cybersecurity they need to avoid breaches so they see no value in Cyber Insurance. Property owners still buy insurance even when they have smoke alarms and sprinkler systems to prevent fires. You buy insurance just in case those measures fail. You can do all the right things but no solution is foolproof.

Because every Cyber Liability/Network Security policy is different, it is vital that the policy address critical terms and conditions. Our 21 point Cyber Liability policy specification addresses key coverage issues that result in a comprehensive policy for little or no increased costs.

get a quote or schedule a meeting today

About

Larry Sukay

I work as an “Outsourced” Risk Manager for CEO’s/CFO’s and business owners. I bring certainty, structure and savings to their organizations. This is achieved through the processes and systems I created as a Risk Manager, Risk Management Consultant and Commercial Insurance Broker. The outcomes of my efforts results in reduce claims, reduced costs and increased profits and peace of mind.

I educate my clients in risk management strategies that include how to prevent claims and how to purchase insurance so that they get the best possible coverage for the lowest cost. As an Outsourced Risk Manager, I work directly with C level executives in the design of complex risk management strategies and alternative funding mechanisms. In the early 1990’s I pioneered a discipline now referred to as behavioral risk management (BRM). The basic premise of BRM is that culture drives behavior, behavior drives loss, and if you control your claims you’ll control your costs.

This concept applies to the vast majority of business risks including; workers compensation claims, group medical claims, management liability, auto, general liability and property exposures. Through my unique Risk Management process, I’m able to provide a company a clear strategy and deliverable products that assist C level executives in dramatically lowering long term insurance costs and increasing employee productivity. I provide out-of-the-box risk management and insurance solutions based upon my experience in the industry for over 40 years.

I specialize in commercial insurance in the areas of:

I am also fully versed in self-insurance programs, high deductible retention programs and the use of captives as a means of risk financing, asset preservation and wealth management.

Grace White

Grace White, has worked in the insurance industry in various roles including underwriting, claims control and marketing for over 25 years. Her business philosophy is to make our clients great by effecting maximum credit potential utilizing the strength in our clients safety program and claims control to implement a cost saving program for our clients. Our carrier partners value long term relationships and a controlled environment, which in the home health care industry is challenging, but not impossible. Together with our focus on safety and practical strategies in risk management, we are able to overcome the struggles and leverage our carriers to provide a competitive and sound product. Caring for those, who care for others is one our highest honors.

Patriot Risk & Insurance Services’ mission is to serve our clients as a true advisor for all insurance and risk management issues. We are an organization comprised of former Risk Managers of some of the largest US companies. As an agency partner with Acrisure, we are the 13th largest broker in the United States.

The Founders of Patriot saw a need to develop new strategies and techniques, specifically in the claims area. We believe our unique approach to claims management benefits our customers in both the short and long term by working closely with our clients to mitigate their claims in a timely and cost effective manner. The industry standard with most insurance brokers is to send a claim directly to the insurance carrier for settlement without looking at it. We take the time to thoroughly investigate a claim first to see if we along with our client can resolve the situation without involving expensive legal counsel. Patriot professionals have up to 30 years of claims experience in reversing seemingly impossible situations and turning them into favorable ones for our clients.

Other client focused services include:

Resources

Resources for Controlling Workers Compensation Costs

We have devised a turn key solution utilizing cost-saving strategies to help our clients control their workers compensation costs. Below are several informational resources outlining these strategies. Please select the links to download our white papers or to listen to our interview.